In the evolving landscape of the short-term rental industry, AirDNA has emerged as one of the most valuable tools for property owners, investors, and real estate professionals. Whether you’re looking to optimize an existing rental, assess the potential of a new property, or understand market trends, AirDNA offers a wealth of data and insights that can help you make informed decisions. As Airbnb and similar platforms continue to change the way people travel and invest in real estate, AirDNA provides a critical competitive advantage through data analytics.

What is AirDNA?

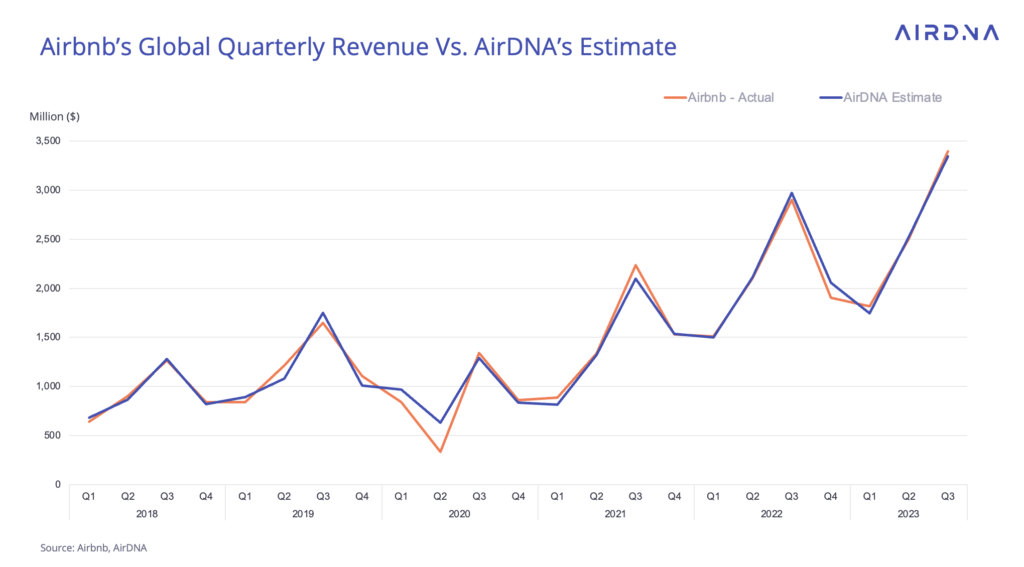

AirDNA is a data analytics platform designed to offer comprehensive insights into the performance of short-term rental properties. It tracks rental listings from popular platforms like Airbnb and Vrbo, providing valuable information on occupancy rates, pricing, revenue, and market trends. By collecting data from millions of rental listings worldwide, AirDNA gives property owners, investors, and managers the ability to benchmark their performance against the broader market and make data-driven decisions.

Founded in 2015 by Scott Shatford, a former Airbnb host, AirDNA was born out of the need for reliable data on the short-term rental market. Shatford realized that, while Airbnb was growing exponentially, there was no tool to help hosts understand market dynamics or forecast their potential income. Today, AirDNA is a leading resource for anyone in the short-term rental market, from individual hosts to large real estate companies.

Key Features of AirDNA

AirDNA provides a wide range of features that make it an indispensable tool for property owners, investors, and analysts. Some of its most valuable features include:

1. MarketMinder

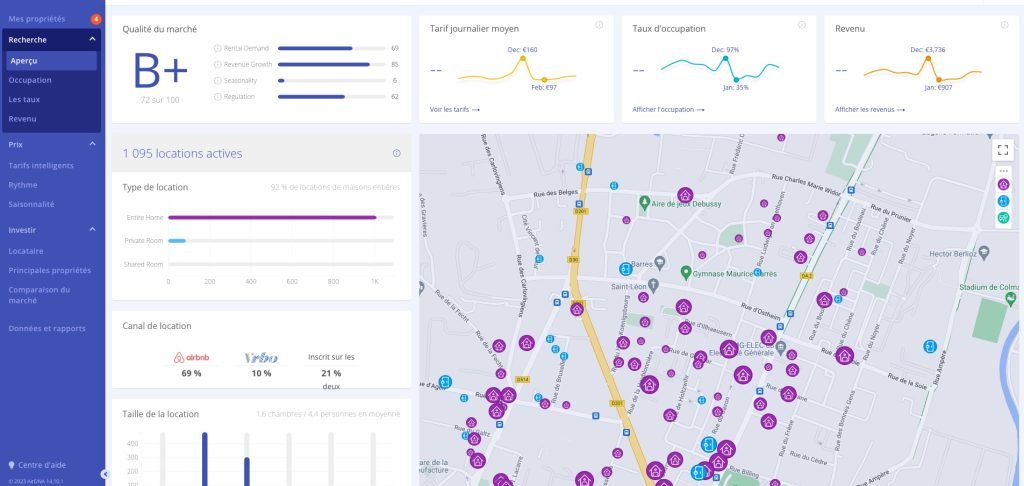

MarketMinder is AirDNA’s flagship tool, offering users access to real-time data on more than 10 million short-term rental properties across 120,000 markets globally. With MarketMinder, users can explore market trends, analyze competitor performance, and identify the best-performing neighborhoods for short-term rentals.

Key insights available through MarketMinder include:

- Occupancy Rates: Users can see how frequently properties in a given area are being rented. This information helps owners assess demand and optimize pricing strategies.

- Revenue Data: AirDNA tracks historical revenue for properties, allowing owners to estimate how much income they can expect to generate in a given market.

- Pricing Suggestions: MarketMinder offers dynamic pricing suggestions based on market demand, seasonality, and local events, helping hosts maximize their earnings.

- Property Comparisons: Users can compare their property’s performance to similar listings in their area, giving them a better understanding of how their rental stacks up against the competition.

2. Rentalizer

One of the most powerful tools offered by AirDNA is Rentalizer, a feature that allows users to estimate the potential revenue of any property as a short-term rental. Rentalizer uses AirDNA’s vast database of market data to calculate projected occupancy rates, average daily rates, and expected revenue for properties based on their location, size, and amenities.

For investors and property managers, Rentalizer is an invaluable tool for evaluating new investment opportunities. It provides a detailed forecast of how much income a property could generate, allowing users to make more informed purchasing decisions.

3. Custom Market Reports

For users who need more detailed and tailored data, AirDNA offers custom market reports that provide deep insights into specific markets or properties. These reports can be especially useful for real estate professionals, large-scale property managers, or investors looking to make high-stakes decisions.

Custom reports typically include granular data on:

- Occupancy trends

- Seasonal demand fluctuations

- Market competition

- Revenue projections

These reports allow users to analyze trends over time and adjust their strategies to stay competitive in changing markets.

4. Enterprise Solutions

In addition to its standard tools, AirDNA offers enterprise solutions for large-scale property managers, real estate developers, and travel industry professionals. These solutions provide access to advanced data sets, API integrations, and custom insights that can be used to optimize entire property portfolios, develop new projects, or support strategic planning efforts.

By providing data on everything from booking patterns to guest demographics, AirDNA’s enterprise solutions allow companies to make informed decisions that boost revenue and improve operational efficiency.

How AirDNA Benefits Investors and Hosts

AirDNA is a game-changer for both novice hosts and seasoned real estate investors. Here’s how the platform benefits each group:

1. For Property Owners and Hosts

For individual hosts or property owners, AirDNA provides critical insights that help optimize short-term rental performance. From identifying the best pricing strategies to understanding occupancy trends, hosts can use AirDNA to increase their revenue and occupancy rates.

- Dynamic Pricing: AirDNA’s pricing recommendations ensure that hosts set competitive rates based on local market conditions, allowing them to maximize earnings without sacrificing occupancy.

- Competitor Analysis: Hosts can track their competitors’ performance and adjust their offerings to stay ahead of the curve, whether through adding amenities, adjusting pricing, or optimizing their listing descriptions.

- Seasonality Insights: By understanding how demand changes throughout the year, hosts can tailor their pricing and marketing strategies to capitalize on peak travel seasons and local events.

2. For Real Estate Investors

For investors looking to enter or expand their presence in the short-term rental market, AirDNA provides invaluable tools for evaluating potential investment opportunities. Rentalizer helps investors estimate the revenue potential of new properties, while MarketMinder provides insights into broader market trends.

- Data-Driven Decision Making: Investors can assess multiple properties, compare potential revenue streams, and identify the most lucrative markets before committing to a purchase.

- Portfolio Optimization: By tracking the performance of properties in different markets, investors can diversify their portfolios and adjust their strategies to maximize returns.

- Risk Mitigation: AirDNA helps investors identify trends and risks in the market, such as oversaturation or declining demand, allowing them to make informed decisions about where and when to invest.

AirDNA’s Role in Shaping the Future of Short-Term Rentals

As the short-term rental market continues to grow, platforms like AirDNA are becoming essential tools for property owners, investors, and industry professionals. By offering access to real-time data and market insights, AirDNA is helping to professionalize the short-term rental industry, making it more accessible and manageable for both new and experienced players.

In the future, as regulations around short-term rentals evolve, AirDNA’s data will likely play a critical role in helping property owners and investors navigate these changes. For example, in cities where regulations are tightening, such as New York City or Barcelona, AirDNA can provide insights into occupancy trends and market shifts, allowing users to adapt their strategies accordingly.

Additionally, as more investors turn to short-term rentals as a source of passive income, AirDNA’s tools will be instrumental in helping them identify high-potential markets, estimate returns, and manage their portfolios effectively.

Conclusion

AirDNA has revolutionized the short-term rental industry by providing property owners, investors, and managers with access to powerful data analytics tools. Whether you’re a host looking to optimize your rental property or an investor seeking the next big opportunity, AirDNA offers the insights and tools you need to succeed in a competitive and dynamic market. With its suite of features, including MarketMinder, Rentalizer, and custom market reports, AirDNA empowers users to make data-driven decisions that lead to higher revenue and improved occupancy rates.